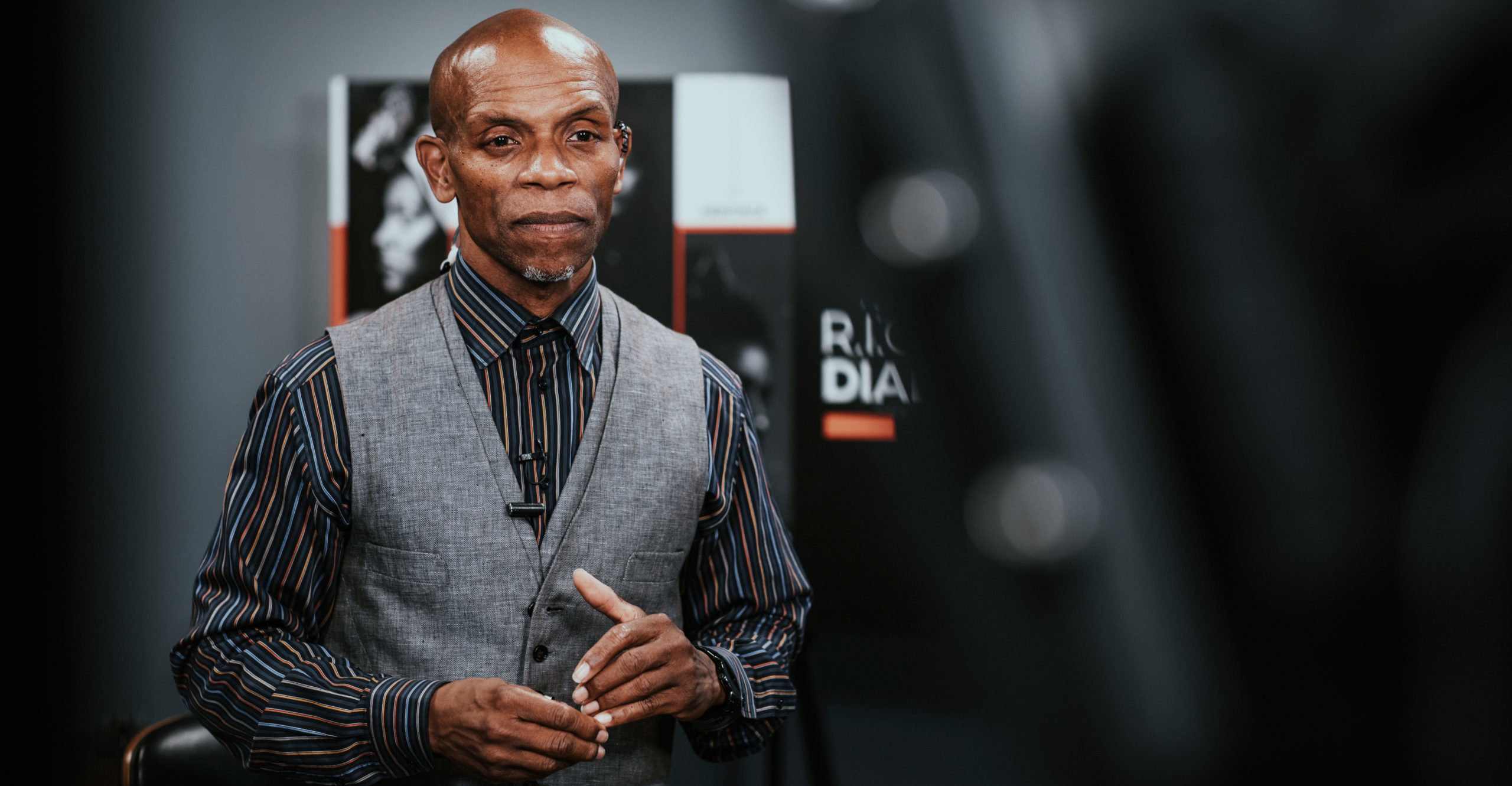

Commercial Real Estate Developer Quintin E. Primo and the Need for Inclusivity

Quintin E. Primo III is one of relatively few African Americans operating at the highest levels of the commercial real estate business. His company, the Chicago-based Capri Investment Group, boasts more than $14 billion in real estate investment transactions completed – with more high-profile deals in the pipeline. Capri Investment Group and commercial and residential real estate development company, The Prime Group, acquired the James R. Thompson Center, a historic building in Chicago’s Loop District. The deal, which Capri expects will take about three-and-a-half years to complete, came about

Quinton E. Primo lll Building a Home for Google at the James R. Thompson Center

by Alan Hughes Quintin E. Primo III is one of relatively few African Americans operating at the highest level of the commercial real estate business. His company, the Chicago-based Capri Investment Group, boasts more than $14 billion in real estate investment transactions completed – with more high-profile deals in the pipeline. The Capri Investment Group and commercial and residential real estate development company, The Prime Group, acquired the James R. Thompson Center, an historic building in Chicago’s Loop District. The center, built in the mid-1980s houses Illinois state government

The Clean Energy Economy: Will Blacks Get Left Behind in the Race to Green?

America continues to plod the course toward a clean energy nation – albeit glacially. Though hampered by an aging infrastructure and other factors, widespread clean energy – or power that does not, in its generation and consumption, add pollution or contribute to climate change – appears to be a certainty. Unfortunately, this particular scenario could lead to yet another great divide for African Americans. As the world slowly moves toward increased clean energy generation, a gap is widening and hindering African Americans positioning themselves to benefit from the

Black Asset Managers and the Fight for Investment Capital

Whether working in academia, a municipal, state or federal department or within Corporate America, Black employees contributing to their retirement plans have one thing in common: their retirement assets are managed almost entirely by people who look nothing like them. And this longstanding dynamic is draining wealth from Black communities. The asset management industry, one of the remaining bastions of the old boy network, is not only frighteningly non-diverse at the upper levels, but those professionals of color within the industry find themselves struggling to raise capital from

Digital Privacy: Is data ownership the next frontier?

As internet usage has become a routine activity, so has the mining, analyzing and monetizing of personal information – much of it done without the individuals’ knowledge. According to a Gallup poll, two-thirds of employees in white-collar jobs work from home at least part of the time, meaning there is more activity and personal data in cyberspace than at any other time in history. Unsurprisingly, the cybersecurity industry has exploded. ResearchAndMarkets.com valued the global cybersecurity market at $183.34 billion in 2020 and predicts it will reach $539.78 billion

Black business leaders win big with explosive growth in SPACs

Jarvis Stewart admits he knew only a little about Special Purpose Acquisition Companies (SPACS). While SPACS have been the rage on Wall Street in recent years, Stewart’s exposure to the financial markets was gained mainly through his longtime friends, which include Christopher Williams, Chairman of Siebert Williams Shank & Co., one of America’s largest minority-owned investment banks and Daniel Black, Managing Partner, The Wicks Group, a New York-based private equity firm. So, when he received a call just a year ago from an old client, a Canadian CEO

What New Workforce Dynamics Mean for Black Professionals

The last two years have resulted in a paradigm shift in the global workforce. The pandemic drastically changed behavioral norms– and businesses and employees alike had to adjust to the new rules of corporate America. Businesses had to identify ways to retain productive employees, particularly during the “Great Resignation of 2021 which saw thousands of employees exit the workforce to seek better working conditions, compensation, and opportunities. As corporations set up for remote working, they also engaged in culture work – having outside consultants perform a culture audit,

How JPMorgan Chase’s Advancing Black Pathways Looks to Help MBEs Grow

In response to the pandemic’s devastating impact on minority-owned businesses and the social justices that mainstream America woke up to last year, JPMorgan Chase announced a five-year $30 billion commitment in October 2020 to provide economic opportunity to Black and Latinx communities. That commitment to Minority Business Enterprises (MBE) includes greater access to capital, coaching, technical assistance and a pledge to boost spending with Black and Latinx suppliers by an additional $750 million.As the head of Advancing Black Pathways, a strategy aimed at strengthening the economic foundation